2022 Property Assessment Notices are on their way; Customer Review Period begins

Today, The City of Calgary mailed nearly 560,000 annual 2022 property assessment notices and opened the Customer Review Period, which runs from January 5 to March 14, 2022.

2022 Assessment Roll

The total value of the 2022 Assessment Roll is $313.5 billion, compared to $297 billion in 2021. The typical residential property market value change from the previous year is 6 per cent and the typical non-residential market value change is -5 per cent.

- The 2022 property assessment values are based on a July 1, 2021 market valuation and physical condition on Dec. 31, 2021.

- The 2022 median single residential assessment is $485,000, compared to $445,000 in 2021.

- The 2022 median residential condominium assessment is $235,000, consistent with the 2021 value of $235,000 in 2021.

Calgary’s City Assessor and Director of Assessment Eddie Lee says, “Calgary’s real estate market, as of July 1, 2021, reflected a hot residential market driven in part by demand for more space in the face of pandemic regulations and restrictions. For non-residential, not surprisingly the office sector continued to decline with persistent high vacancy while retail and industrial markets held relatively stable.”

· 2022 Property Assessment Roll Key Findings

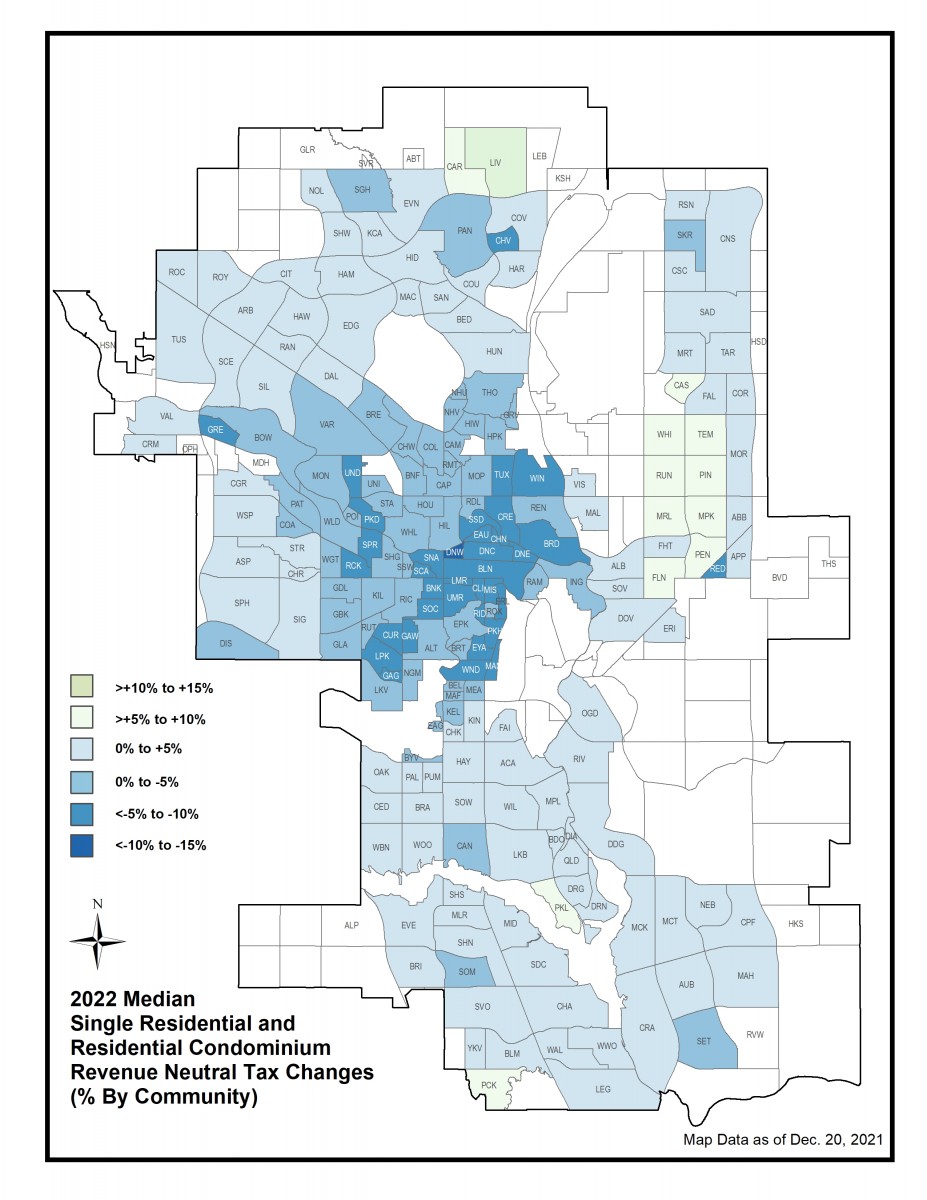

o In 2022, The City of Calgary mailed nearly 560,000 Assessment Notices, including more than 46,000 Assessment eNotices, to Calgary property owners. o The total value of the 2022 Assessment Roll is $313.5 billion, an increase of $16.5 billion in value from last year. o As a result of the 2022 Assessment, the typical assessment change between this year and last year is 6 per cent for residential properties and -5 per cent for non-residential properties. o The 2022 median single residential assessment (excluding condominiums) is $485,000 compared to $445,000 in 2021. o The 2022 median residential condominium assessment is $235,000 consistent with the 2021 value of $235,000. o Approximately 92 per cent of revenue neutral taxes from residential properties will stay within 10 per cent of last year’s taxes due to the 2022 assessment.o Single Residential: The detached and semi-detached inventory was Calgary’s hottest real estate market increasing 9 per cent from last year. Typical inner-city assessments increased 3 per cent, while suburban assessments increased 10 per cent.o Residential Condominiums: The townhouse market experienced modest gains with a 4 per cent increase from last year. The apartment condominium market struggled during the valuation period seeing a decrease of 2 per cent from last year. o Multi Residential: The rental apartment market was stable increasing 1 per cent from last year. Fourplexes and townhouses saw their value appreciate more than 6 per cent. Low rises were flat, and high-rises fell 1 per cent.

o Approximately 73 per cent of non-residential properties’ revenue neutral taxes will stay within 10 per cent of last year’s taxes.

o Industrial: Overall, the industrial market has remained stable with a 2 per cent decrease in value.

o Office: The office property market continued to see challenges over the past year and decreased -10 per cent overall. Pandemic public health restrictions, work from home arrangements and the general state of economic conditions for those businesses which typically occupy offices have combined to cause increasing vacancy and lowered property values for most office sectors in Calgary.

o Retail: Overall, retail values have decreased by 1 per cent which can be seen as relatively stable year over year with moderate variation depending on the property type. Smaller retail property values are relatively stable and larger format freestanding and grocery stores continue to perform very well. Malls and retail in the downtown continue to see a decline in value.

2022 Customer Review Period

The Customer Review Period is an important time period for property owners to check, review and compare their assessment for accuracy, fairness and equity. To do so, property owners are encouraged to visit calgary.ca/assessment to access our secure online Assessment Search tool to update their residential property details, compare their property with other similar properties, review property market and trend reports and sign-up for eNotice.

“The Customer Review Period is a top priority for Assessment,” says Eddie Lee, Calgary’s City Assessor and Director of Assessment. “During this time, Assessment staff and resources are fully dedicated to serving taxpayers and answering their questions.”

Assessment Changes’ Tax Implications

Annual property assessments are integral to The City’s tax process. Knowing how property assessments work and how they are prepared can help property owners anticipate their tax share, well before tax bills are mailed in May 2022, helping them to budget accordingly.

This year, homeowners, who own a single residential property, are expected to have their tax share increase due, in part, to the 2022 annual assessment. This increased tax share combined with the Council budgetary changes will result in an overall increase of 6.13 per cent to their 2022 municipal property taxes excluding rebates, based on the median assessed home of $485,000 and the typical assessment change of 6 per cent between this year and last year.

Homeowners who own a residential condo, are expected to have their tax share decrease due to the 2022 annual assessment. This decreased tax share combined with the Council budgetary changes will result in an overall decrease of 2.62 per cent to their 2022 municipal property taxes excluding rebates, based on the median assessed condo of $235,000 and the typical assessment change of 6 per cent between this year and last year.

Property owners are encouraged to use the Property Tax Calculator to learn how their individual tax share may have changed due to their property’s year-to-year change in assessment. It is important to note that each property’s change in tax will vary because the process of assessing properties each year results in taxes being re-distributed among properties.

Property owners who have questions about their property assessment can speak to our team directly at 403-268-2888. Hours are Monday to Friday 8 a.m. - 4:30 p.m.

For more information please visit calgary.ca/assessment

-30-

Backgrounder

An assessment is the market value of a property (buildings and land) that is used to calculate each property owner’s share of taxes.

Assessed values are determined through a mass appraisal process, which is a way to value a group of properties using common data, including market changes to ensure equitable valuations. Assessments are prepared annually by The City of Calgary, as mandated by the Municipal Government Act.

2022 Assessment Key Dates

Date | Activity |

| July 1, 2021 | Valuation date for 2022 Assessment Roll |

| Dec. 31, 2021 | Physical condition and characteristics date of property for the 2022 Assessment Roll |

| Jan. 5, 2022 | 2022 Assessment Notices issued |

| Jan. 5 – March 14, 2022 | 2022 Customer Review Period |

| March 14, 2022 | Final date to file a complaint with the Assessment Review Board |

| May 2022 | 2022 Property Tax bills mailed |

| June 30, 2022 | 2022 Property Taxes due |